TL;DR: Ultra Mega Trader (UMT) is the fastest, safest, and simplest way to automate TradingView strategies compared to traditional APIs or third-party bots. With UMT, orders are placed directly through TradingView’s broker/exchange connections—meaning no middleware, no risky API keys, and no coding required. Subscribe today to unlock no-code automation without the technical headaches.

Why Compare UMT vs APIs/Bots?

If you’ve ever searched for “How to automate TradingView with my broker”, you’ve probably seen guides for API scripts, third-party bots, or custom-coded webhooks. While these can work, they bring drawbacks: latency, security risks, steep learning curves, and ongoing maintenance. Ultra Mega Trader solves these by leveraging TradingView’s native broker/exchange integrations—and layering no-code automation on top.

Speed & Latency: Why Every Millisecond Matters

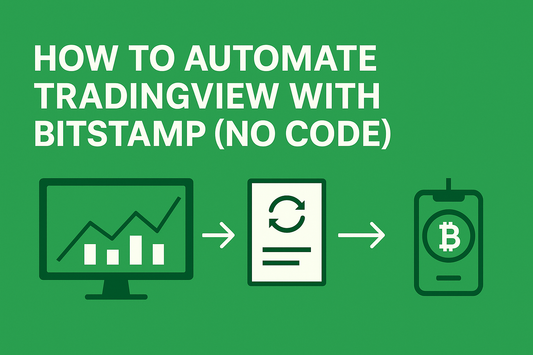

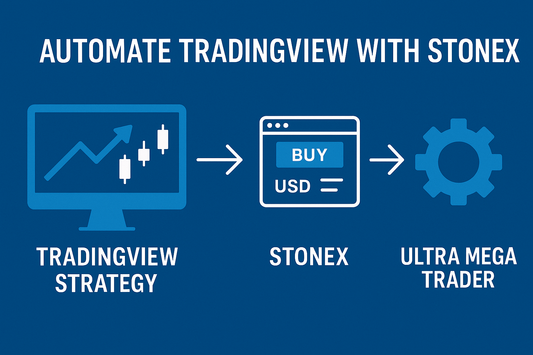

In futures, forex, crypto, or fast-moving equities, even half a second can flip a fill. Most bot/API setups insert extra hops between signal and execution:

- API/Bot flow: TradingView alert → webhook → middleware/server → API → broker/exchange execution

- UMT flow: TradingView signal → broker/exchange execution (direct login inside TradingView)

With UMT there’s no middleman—signals fire straight to your broker/exchange (e.g., Interactive Brokers, TradeStation, OANDA, FOREX.com, AMP Futures, Coinbase Advanced, Alpaca). That means lower latency, fewer failure points, and more consistent fills.

Security: The Most Overlooked Advantage

APIs/bots require generating API keys and pasting them into third-party software—risking broad account access and extra attack surfaces.

- No keys with UMT. You log into your broker/exchange inside TradingView.

- No third-party servers touching your credentials.

- Native TradingView security protects your session.

Result: institutional-grade security with zero key management.

Reliability & Uptime

Bots/scripts depend on PCs, VPSs, or cloud servers staying online—and on APIs not changing. UMT runs where you already trade: inside TradingView with your connected broker/exchange. If TradingView and your broker are up, UMT executes.

Setup Complexity

Typical bot setups require keys, servers, webhooks, and debugging. UMT setup is simple:

- Log into your broker/exchange inside TradingView (paper trade first).

- Subscribe to UMT and connect it to your strategy.

- Set size, stops, targets, and preferences.

- Click Start—you’re live.

Maintenance & Scalability

Bots need patches and break with API updates; scaling means cloning servers/configs. UMT works across TradingView-supported brokers and assets without juggling infrastructure. Popular coverage includes IBKRTradeStationOANDAFOREX.comAMP FuturesAlpacaCoinbase Advanced (subject to your TradingView connection and account permissions).

UMT vs API/Bots: Side-by-Side Comparison

| Feature | Ultra Mega Trader | API/Bots |

|---|---|---|

| Execution Speed | Direct TradingView → broker/exchange. Minimal latency. | TradingView → webhook → server → API → broker. Adds delay. |

| Security | No API keys; secure TradingView login. | Requires API keys; often stored on servers. |

| Reliability | Runs natively with TradingView + broker integrations. | Depends on VPS uptime, internet stability, and scripts. |

| Setup Complexity | No-code, ~5-minute setup. | Keys, webhooks, servers, debugging. |

| Scalability | Works across TradingView-supported brokers/assets. | Multiple bots, keys, configs to scale. |

| Maintenance | Zero middleware to maintain. | APIs change; servers break; needs upkeep. |

Final Thoughts: Why UMT Wins

APIs/bots can be powerful but trade speed, security, and simplicity for complexity. Ultra Mega Trader uses TradingView’s direct broker/exchange connections with a no-code layer—so you get faster execution, better security, and effortless reliability.